The Indian government's recent decision to impose additional charges on digital payments has caused shock among the country's people. The government has been a strong advocate of digital payments, but it now plans to levy additional charges on these transactions. The National Payments Corporation of India (NPCI) has recommended these charges, and they will come into effect from 1st April, the start of the new financial year.

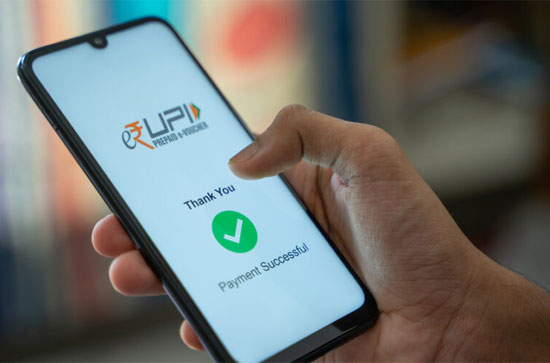

Most people in India make payments through UPI, using payment apps like PhonePe, Google Pay, Amazon Pay, and Paytm. The NPCI has recommended that additional charges be imposed on financial merchant transactions made through UPI, including money transfers and cash payments. These charges will be levied on all banking and non-banking financial transactions across the country.

According to the NPCI circular, an additional charge of 1.1 percent will be levied on customers making transactions above Rs 2,000 through UPI. The issuer of the prepaid payment instrument will have to pay a wallet loading service charge of approximately 15 basis points to the remitter bank after the additional charges come into effect. However, there will be no charges for peer-to-peer (P2P) or peer-to-peer merchant transactions between bank accounts and PPI wallets.

The additional amount collected from UPI users will be used by the government for the development of other sectors. For example, 0.5 percent will be allocated to fuel transfers, 0.9 percent to telecom, utilities, post office, education, and agriculture, and 1 percent to mutual funds, insurance, and railways.

The NPCI will review the levy of these additional charges on 30th September and will consider whether to extend, add, reduce, or remove them. In January this year, NCPI recorded financial transactions worth 12.98 lakh crore rupees.